Study Abroad Made Affordable: Smart Scholarships, Loans & Remittance Tips for Indian Students

Every Indian family dream of overseas education but the ₹25–30 lakh debt that follows often turns that dream into pressure. With tuition, living costs, and currency differences rising, most students struggle to plan finances smartly. This blog shows you how to fund your study abroad journey through scholarships, low-interest loans, and smarter remittance planning — reducing costs by 40-60%.

Why Most Indian Students Struggle with Study Abroad Financing

For Students & Parents:

- Average international education cost: ₹30-50 lakhs (undergraduate) and ₹20-35 lakhs (postgraduate)

- Hidden costs ignored by 71% of families: Living expenses add 30-40% to tuition

- Interest paid over loan lifetime: ₹8-15 lakhs extra on a ₹25 lakh loan

- Scholarship opportunities missed: 82% of students don’t apply to 5+ scholarships

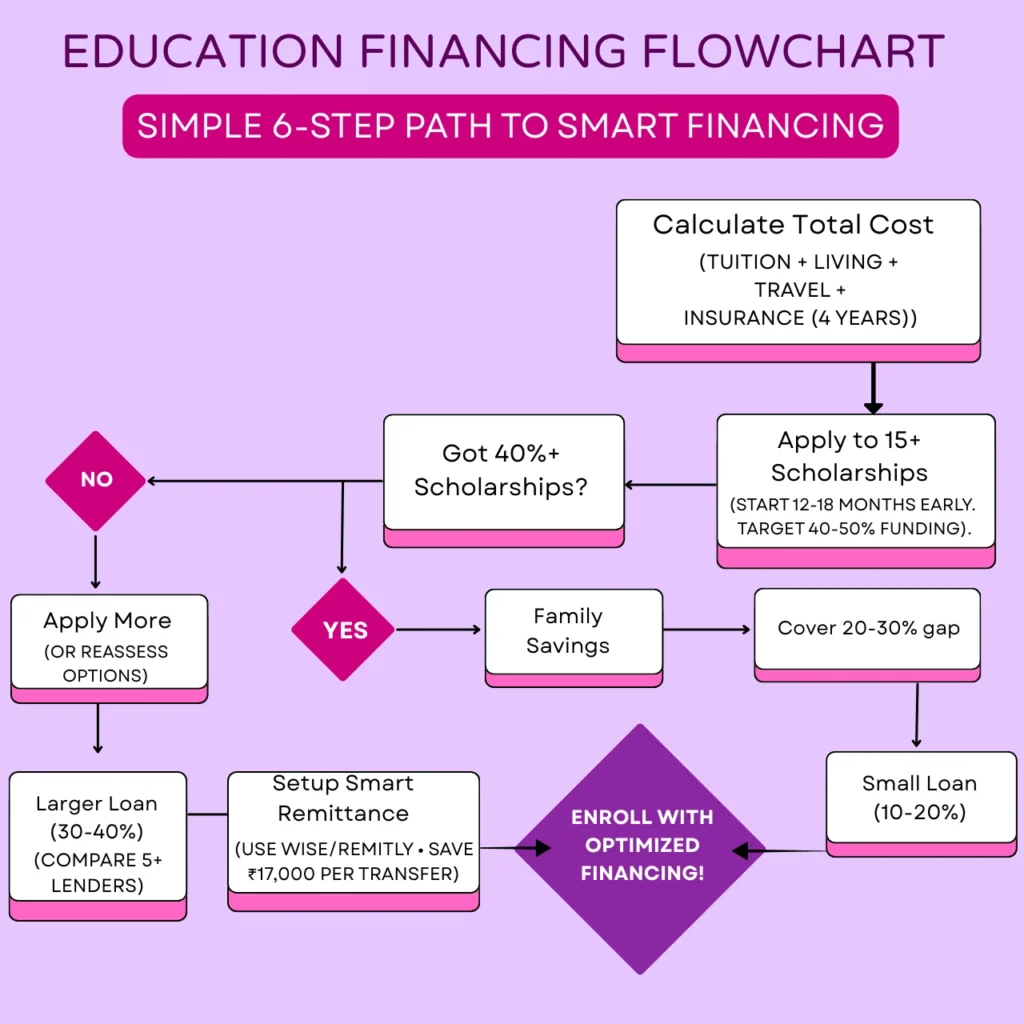

The Problem with “Just Take a Loan” Mentality: Most families rush into education loans without exploring scholarships first, costing them lakhs in unnecessary debt. The smart approach: Scholarships first, loans as supplements, remittance optimization throughout.

Understanding Today’s Global Education Finance Options

The cost of education continues to rise globally, making financial aid more crucial than ever before. Students today must become savvy financial planners, exploring multiple avenues for education funding while minimizing long-term debt burden. The key lies in understanding the diverse landscape of student loan options, student scholarships, and innovative remittance solutions that can significantly reduce education expenses.

Smart financing isn’t just about finding the cheapest option—it’s about creating a sustainable financial strategy that aligns with your educational goals and future earning potential. This approach requires careful consideration of tuition financing options, education budgeting, and long-term student debt management.

Scholarships That Make Study Abroad Affordable for Indian Students

Student scholarships represent the holy grail of education funding—free money that doesn’t require repayment. The scholarship landscape is incredibly diverse, offering opportunities for students across academic achievements, financial backgrounds, and career aspirations.

Merit scholarships reward academic excellence, leadership qualities, and exceptional talents. These awards recognize students who have demonstrated outstanding performance in academics, sports, arts, or community service. Many universities offer automatic merit scholarships based on standardized test scores and GPA thresholds, making them accessible to high-achieving students.

Graduate scholarships provide advanced degree seekers with opportunities to pursue specialized fields without overwhelming financial burden. These awards often come with research assistantships or teaching responsibilities, providing valuable professional experience alongside financial support.

For students pursuing education abroad, international scholarships open doors to world-class institutions. Countries like Germany, Canada, Australia, and the UK offer numerous scholarship programs specifically designed for international students. These opportunities often cover not just tuition but also living expenses and travel costs.

The scholarship applications process requires strategic planning and attention to detail. Start researching opportunities at least 12-18 months before your intended enrollment date. Create a compelling personal statement, gather strong recommendation letters, and maintain organized records of your achievements and extracurricular activities.

Student Test Case

Case study: How planning saved Sneha ~45%

Sneha (Hyderabad) combined a DAAD scholarship (monthly stipend + tuition help) with a targeted low-interest education loan and used Wise for regular tuition transfers.

Result: ≈45% lower total cost vs. doing the full program overseas (scholarship + lower remittance fees + partial study in India). DAAD covers living stipends; Wise reduces FX/fees.

Smart Education Loans: Choosing Low-Interest & Flexible Options

When scholarships don’t cover the full cost of education, education loans become essential tools for accessing quality education. The key is understanding the various student loan options and selecting the most advantageous terms for your situation.

| Loan Type | Interest Rate | Processing Fee | Collateral Required | Moratorium Period | Best For |

| Public Sector Bank | 9.5-11.5% | 1-2% | Yes (>₹7.5L) | 12 months | Lower rates with collateral |

| Private Bank | 10.5-13.5% | 2-3% | Yes (>₹7.5L) | 6-12 months | Faster processing |

| NBFC | 11-15% | 2-4% | No | Variable | No collateral option |

| International Lender | 8-12%* | 1-2% | Sometimes | 6 months | Foreign credit building |

| Government Schemes | 4-7%** | Nil/Minimal | No | 12+ months | Central govt subsidies |

Federal student loans offer several advantages over private alternatives, including fixed interest rates, income-driven repayment plans, and potential loan forgiveness programs. These government-backed loans should typically be your first choice when additional funding is needed beyond scholarships and personal savings.

Private student loans can fill gaps when federal aid limits are exceeded, particularly for graduate programs or expensive professional schools. However, these loans require careful evaluation of interest rates, repayment terms, and borrower protections. Shop around with multiple lenders to secure the most favorable terms.

Low-interest loans can significantly impact your long-term financial health. Even a difference of 1-2% in interest rates can save thousands of dollars over the life of a loan. Consider credit union loans, employer-sponsored education benefits, and state-specific loan programs that might offer better terms than traditional bank loans.

Smart borrowing principles include borrowing only what you need, understanding all terms and conditions, and having a clear repayment strategy before graduation. Many students benefit from making small payments on loan interest while still in school to prevent capitalization.

Save Big on International Transfers: Remittance Tips for Students & Families

For international students and families supporting education abroad, international money transfer costs can significantly impact overall education expenses. Traditional banking methods often impose high money transfer fees and unfavorable foreign exchange rates, making regular cross-border payments expensive.

Modern digital remittance platforms have revolutionized global money transfers, offering competitive exchange rates and lower fees than traditional banks. Services like Wise (formerly TransferWise), Remitly, and other fintech solutions provide transparent pricing and faster transfer times for study abroad financing.

Online money transfer services typically offer better foreign exchange rates and lower remittance costs compared to conventional wire transfers. By choosing the right platform, families can save hundreds or even thousands of dollars annually on money transfer fees.

Consider setting up regular transfers during favorable exchange rate periods, using forward contracts to lock in rates for future payments, and exploring multi-currency accounts that can hold funds in different currencies until needed.

Build Your Personalized Study Abroad Financing Plan

Successful education budgeting requires integrating all three financing pillars into a cohesive strategy. Start by calculating total education expenses, including tuition, accommodation, living costs, books, and travel expenses for international students.

Educational investments should be viewed through a long-term lens. Consider the return on investment for different degree programs, potential earning increases, and career advancement opportunities. This analysis helps justify borrowing decisions and scholarship pursuit strategies.

Emergency funding planning is often overlooked but crucial. Maintain access to additional funds for unexpected expenses, medical emergencies, or changes in financial circumstances. This might include maintaining a line of credit, emergency savings, or family financial support systems.

For families managing undergraduate funding and graduate scholarships simultaneously, coordination between different funding sources becomes essential. Some scholarships have restrictions on other aid received, while loan eligibility might change based on scholarship awards.

Your Path to Educational Success

Smart financing for education requires a proactive, multi-faceted approach that combines scholarships, strategic borrowing, and optimized remittance solutions. At MAK Consultants, we guide students and families through these complex decisions, ensuring access to quality education without overwhelming financial burden.

Remember that financial aid landscapes change regularly, with new scholarship opportunities, loan programs, and remittance solutions emerging frequently. Stay informed about opportunities in your field of study and maintain flexibility in your financing strategy.

Quick Study Abroad Finance Facts

- 1.33 million Indian students were studying abroad (Jan 2024). View on: MEA India

- Average total cost for an overseas degree typically ranges from ₹20–50 lakh (varies by country & program). Check on the source: lorien.finance

- Most students miss scholarship opportunities: surveys/reports show <30% apply widely — meaning ~70–82% miss many scholarships (awareness & planning gap). From the article: Medium

- Remittance / transfer losses: Indian families lose ₹1,700 crore yearly to bank FX/hidden fees; fintech (Wise/Remitly) can cut fees significantly (mid-market rates / lower fees). From the article: The Economic Times

- Risk when credits transfer poorly: transfer inefficiencies can cause lost credits (avg ~43% lost) and can add $13k–$26k in extra costs for students in some systems. From the source: chepp.org

Frequently Asked Questions

1. How many Indian students go abroad for higher studies each year?

According to recent data from the Bureau of Immigration (BoI), around 7.6 lakh (760,073) Indian students went abroad for higher studies in 2024.

This shows the strong demand—but also the high competition and cost involved.

2. Which major scholarships and loans can help make studying abroad affordable for Indian students?

Scholarships like those offered by entities such as DAAD (Germany) and various government/industry schemes are becoming more accessible. Simultaneously, state and national loan schemes (e.g., those offering up to ₹15 lakh at subsidized rates) have seen large growth — one scheme reported a 168 % increase in general-category student approvals.

Combining scholarships + favorable loans + smart remittance planning can significantly reduce total cost.

3. How can Indian students reduce the total cost of studying abroad?

By combining scholarships, low-interest education loans, and using low-fee remittance platforms.

4. Which scholarships are best for Indian students abroad?

DAAD (Germany), Chevening (UK), Fulbright-Nehru (USA), and Australia Awards are top options.

5. Is it cheaper to start my degree in India or abroad?

Yes, many Indian students now use a “2+2” or “twinning” approach (2 years in India + 2 years abroad), or partially study in India + transfer abroad. This can reduce the overall cost by 30-50% or more depending on destination, currency, and living expenses. Planning ahead with credit-transfer rules and partner universities is key.

Know about twinning approach by reading our full blog on NEP 2020: Smarter & Cheaper Study Abroad Plans for Indians

6. Is it cheaper to study abroad with a twinning program?

Yes, completing part of your course in India can cut total expenses by 30–50%.

7. What should Indian students consider when selecting a destination and university abroad?

Key pain-points to check:

- Tuition + living cost + exchange-rate risk

- Visa & work-permit rules (post-study work options)

- Credit transfer / recognition (can you return or transfer credits?)

- Scholarship & loan availability

- Support systems, culture-fit, and ROI of the degree

Given the numbers (e.g., growth in Indian student mobility), these factors matter more than ever.

Confused about choosing right destination for study abroad? Read our blog guide on How to Choose the Right Country for Your Study Abroad.

8. How can Indian students and families save on money transfers and remittances when paying overseas tuition?

Standard bank FX/transfer fees can eat into your budget significantly. Using fintech services like Wise or Remitly or mid-market rate services can reduce hidden costs and save thousands of rupees annually.

For example, remittance-loss figures in India have been reported in the thousands of crores per year due to high fees.

So, planning your currency exchange and transfer method is a critical component of affordable study abroad financing.

Conclusion

Your educational dreams shouldn’t be limited by financial constraints. With proper planning, research, and the right combination of funding sources, quality education remains within reach for motivated students ready to invest in their future success.

For the latest updates on international scholarship opportunities and current exchange rates, visit Scholarships.com for comprehensive scholarship databases and application resources.

Ready to make your study abroad dream affordable?

Connect with MAK Consultants today for your free personalized finance plan — including top scholarships, low-interest loan options, and remittance savings tailored to your destination.